value, building

better businesses

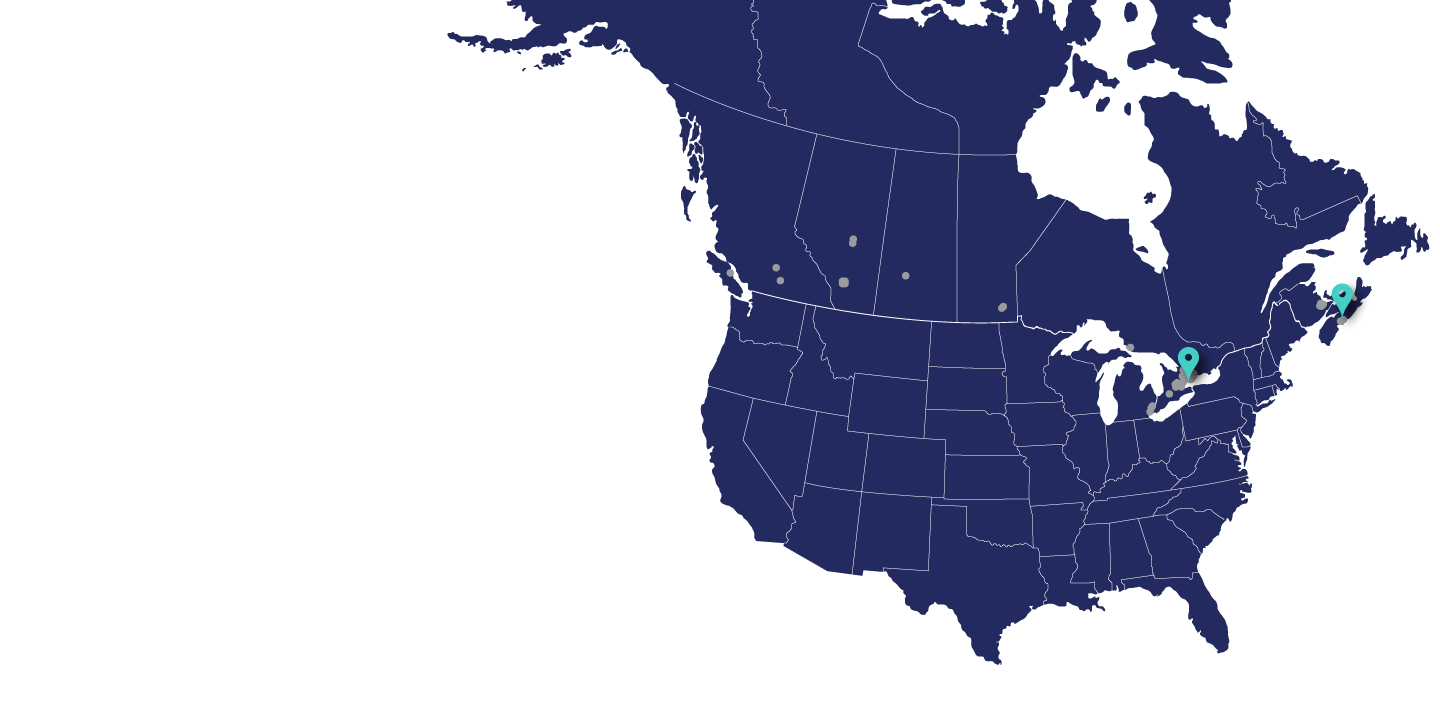

Imperial Capital has been successfully building better businesses since 1989. Based in Toronto, we are a private equity firm with a focus on partnership opportunities in the U.S. and Canadian mid-market, and a history of investing with entrepreneurial and founder‐owned companies across the healthcare, business and consumer service industries.

Platform investments since 1989

Revenue CAGR Fund IV, Fund V and Fund VI

Tuck-in acquisitions2021 - 2024

Gross multiple of capital 1Funds IV-VIII

1. 2.0x net multiple of capital for Funds IV-VIII

Focused on growth

Through our partnership, we help our portfolio companies execute on a growth-focused strategy, equipping them with the essential resources needed for substantial organic and strategic expansion.

Revenue CAGR

CEO multiple of capital

For all Fund V, Fund VI and Fund VII portfolio companies.

1. During investment period since 2017.

Headquarters for Fund V, Fund VI, Fund VII and Fund VIII companies

Headquarters for Fund V, Fund VI, Fund VII and Fund VIII companies

Added locations for Fund V, Fund VI, Fund VII and Fund VIII companies

Added locations for Fund V, Fund VI, Fund VII and Fund VIII companies